Save Money With These Trading Platforms:

Content:

In recent years, numerous new crypto margin trading platforms have been established. The first of these was the Bitcoin Mercantile Exchange (BitMEX), which has been number 1 in this business for most of the time. Unfortunately they’ve got into legal trouble lately which lead to a dramatic decrease of usage.

However, there are a number of other brokers that offer interesting advantages and can certainly represent an alternative to BitMEX.

In the following, we’ll introduce the best Bitcoin and altcoin brokers we know and provide all the important details about them regarding supported coins, leverage levels, ID verification and where they can be used.

Binance is considered world’s largest crypto trading platform. They not only offer an advanced trading platform with more than 80 cryptocurrencies but a range of other financial services for cryptocurrencies. Those include savings accounts, staking accounts, crypto lending and even high leveraged Bitcoin AND altcoin Futures (derivatives).

Many altcoins can be traded in leveraged spot market trades. The amount of leverage ranges from 3x, 5x or 10x maximum for leveraged spot market trades and from 20x to 125x with Futures, depending on the coin. Binance has a wide range of altcoin Futures that can be traded on high leverage, other than most other brokers where you mostly find Bitcoin and maybe some of the big market caps as Futures.

Binance has been hacked several times, but this never ended up in losses for the customers as the platform had an excellent crisis management and could return lost funds to affected accounts quickly.

PrimeXBT is No.4 in our trading volume comparison (performed in 11/19). The Bitcoin margin trading platform has a wider portfolio of trading assets compared to the aforementioned platforms.

Suitable For Traders Active In Many Markets

The platform offers CFDs in the form of perpetual contracts, not only for cryptocurrencies but also for classic assets such as oil, gas, and major indices. Other than with the other brokers, on PrimeXBT you can either trade the altcoins against the US Dollar, but also against Bitcoin.

Crypto CFDs on PrimeXBT:

BTC/USD, ETH/USD, EOS/USD, LTC/USD, XRP/USD, ETH/BTC, EOS/BTC, LTC/BTC, XRP/BTC

PrimeXBT Classic CFDs (Stock Indices):

- BRENT (Brent Crude oil index)

- CRUDE (Crude WTI oil index)

- NAT.GAS (Natural Gas index)

- GER30 (30 major German companies, also known as DAX 30 Index)

- SP500 (Index of 500 largest publicly traded US companies)

- NASDAQ (the largest electronic stock exchange in the USA, measured by the number of listed companies)

- HK-HSI (Hong Kong’s leading stock index)

- AUS200 (Index of 200 largest publicly traded Australian companies)

- JAPAN

- UK100 (Index of 100 top publicly traded British companies)

PrimeXBT Forex CFDs:

- Major Forex Pairs (USD, EUR, GBP, AUD, JPY, XAG, XAU, CHF)

PrimeXBT’s trading engine works well, but they have less automated order settings. Stops and Take Profits are included, also OCO.

Unfortunately, it’s all more or less the same countries that are excluded from Bitcoin margin brokers. For PrimeXBT the same is true for BitMEX and the others: US traders, Québec etc. are not allowed to use the platform.

With it’s high liquidity, stable trading engine and a wider range of assets, this broker is a good choice for very active day traders who trade in all kinds of markets.

PrimeBit is the first Bitcoin margin trading platform to offer as much as 200x leverage, which is double the amount of their competitors. So this is the place to go for hardcore gamblers with an extreme risk appetite.

3 Trading Products Only (Perpetual Contracts)

BTC/USD, ETH/USD, LTC/USD

Another special feature of Primebit is that you can also trade 2 major altcoins with such high leverage. This concerns ETH and LTC – Ethereum and Litecoin, which is really cool as usually leverage for altcoin markets is way lower.

Apart from that their fees and funding rate structure is the same standard as with BitMEX and others.

The platform is very professional and the trading engine works well; their support is good as far as we can say.

According to our check in December 2019, ByBit is the 3rd largest Bitcoin margin trading broker in regard to 24H trading volume, making it one of the best online crypto trading platforms for leveraged CFD trading. The young BitMEX competitor has only come up in spring 2018, but they are already one of the leading platforms in their field.

Besides relatively high liquidity, Bybit has another similarity with BitMEX, which is a comprehensive set of advanced order types. The only option we can’t find there is the “hidden” option, which is necessary for iceberg orders. A trailing stop they have, but it’s not that obvious as with BitMEX, as it isn’t called like that on Bybit. If you want to use that option, you need to check their guides on their website (e.g. here).

4 Trading Products Only (Perpetual Contracts)

On Bybit you can trade Bitcoin, Ethereum, EOS and Ripple, each in the form of CFDs, against the US Dollar. Those trading products are perpetual contracts.

BTC/USD, ETH/USD, EOS/USD, XRP/USD

Advanced Trading System For High Automation

Due to it’s flawless trading engine ByBit is a popular choice among traders who are directly searching for an alternative to BitMEX for whatever reason.

What can’t be found on Bybit are other assets, like Bitcoin Futures (with settlement date in the future), although the state to have Futures as well. But this is due to the fact that those perpetual contracts can be seen as kind of a futures trading product, but without settlement date.

Also, they don’t have other products, such as options or other CFDs (in contrast to PrimeXBT).

Also Suitable For Pro Traders with Big Positions

Due to their top trading system with a lot of automated trading setting options combined with high liquidity Bybit is a good choice for professional Bitcoin traders, even with bigger positions.

BitMEX was the first bitcoin margin trading platform with perpetual contracts at up to 1:100 leverage. Since 2018 a range of other exchanges have come up with similar trading products as direct competitors. But BitMEX still seems to be the leading platform in this particular area, with the highest liquidity by far.

This is why BitMEX is the no.1 spot for traders with large positions.

Traders from all over the world are allowed to use the broker, except the USA and the other countries as stated above. This is due to missing authorization / regulation in the named jurisdictions.

Highest Liquidity + Most Powerful Trading Engine

The broker has a very powerful trading engine that works stable, fast and reliable.

The platform is best for professional traders who are used to margin trading of this kind, since BitMEX has the most comprehensive setup of advanced order types in this industry including trailing stop orders and iceberg orders.

BitMEX Offers 3 General Contract Types:

- Perpetual Contract

(Bitcoin, Cardano, Bitcon Cash, EOS, Ethereum, Litecoin, Tron, Ripple) - Bitcoin Futures (XBTZ19 and XBTH20)

- Bitcoin Options (Ups & Downs)

Specialized on Bitcoin trading (and some altcoins), BitMEX doesn’t offer any other tradeable assets, in comparison to PrimeXBT which opens the door to more financial markets.

New sign ups get a 10% discount on trading fees for 6 months, an offer that shouldn’t be underestimated since you can save quite a bit of money that way. Get the discount through this link.

Largest Portfolio For Day Traders

SimpleFX is a comprehensive CFD broker with lots of possibilities. Those concern their payment methods as well as their portfolio of trading instruments.

With SimpleFX you can buy cryptocurrencies with fiat money in case you don’t have any yet. In this case you need to make the ID verification, as always when fiat money is involved. For traders who don’t need to buy cryptos, KYC isn’t necessary.

In terms of trading instrument they have cryptocurrencies, Forex, stocks, commodities, precious metals, all in the form if derivatives (CFDs).

The list of all their products would be very long, that’s why we don’t put them all here. But let’s at least have look at the crypto trading pairs:

BTC/USD, BCH/USD, ETH/USD, ETC/USD, LTC/USD, XRP/USD

Social Trading For Sharing Ideas

What’s also special about SimpleFX that they include a social trading platform where traders can easily share trading ideas.

Another interesting thing about SimpleFX is that they have a renommated trading app. Althoug day traders don’t usually use mobile apps that much for trading, it can still be useful to have a good app in case of emergency.

eToro is one of the best-known international broker platforms. Other than all trading platforms mentioned above eToro is a lisenced and regulated broker. The company is officially licensed by the CySEC (Cyprus) and the FCA (UK).

eToro has more to offer than plain trading, as they have extra services such an active community of traders sharing ideas. So beginners can benefit from copy trading, and traders can compare what strategies others use and compare success rates.

Regulated Crypto Margin Trading Platform With Tons Of CFDs

As a large broker with years of experience eToro offers a wide range of CFDs. This not only concerns a relatively big portfolio of cryptocurrencies that can be traded against different major fiat currencies. They also have ETFs, Forex, stocks, commodities and precious metals, all as CFDs.

Be aware that eToro only allows 2x leverage for cryptocurrencies. In the USA and for US citizens eToro doesn’t provide any CFD trading at all, meaning no leverage. US Americans can only perform simple 1:1 buy and sell orders.

Their trading interface allows for buy and sell orders with stop loss, take profit orders and even trailing stops. On this platform CFD traders will hardly miss any tradeable asset.

Bitcoin & Altcoins Now also Withdrawable

In the past people could buy and sell Bitcoin & co with eToro but never really withdraw the underlying assets. Now this has changes, so you can really buy BTC and other coins and send them to your home wallet. eToro also has an own wallet app that you can use for storage. But the best is always to get your coins home. Remember: not your private keys – not your coins..

Leverage is only very low for cryptocurrencies, other assets can be traded with industry-standard leverage.

People who prefer a regulated broker can give this platform a try, actually aToro is quite popular among retail investors.

Simple & Clear Trading Platform

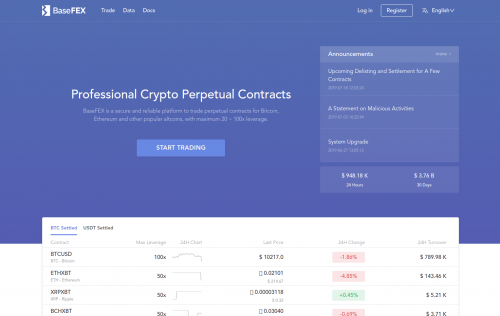

BaseFEX is another high leverage bitcoin trading broker you might not yet have heard of since they are also relatively new. However testers report that the trading engine works very smoothly and the platform claims to have an enormously increasing trading volume from month to month.

They are one of the no-KYC-brokers where sign up is super fast and anonymous and there are no other deposit possibilities than BTC and USDT (Tether).

The 100x leverage is for Bitcoin only, but 1:20 for the altcoin CFDs is still high as well.

The trading platform only has a few trading instruments. Bitcoin and 5 altcoins can be traded against the US Dollar (or USDT in the case of Bitcoin and Ether).

BaseFEX Perpetual Contracts:

BTC/USD, BTC/USDT, ETH/XBT, ETH/USDT, XRP/XBT, BCH/XBT, LTC/XBT, BNB/XBT

Visually the broker focuses on a clean interface with little distractions, yet the underlying system is quite professional and complex, since they have certain advanced order settings not every platform has. What we can’t find is trailing stops and iceberg oder settings.

Generally BaseFEX looks like worth a try for traders who perfer a very simple and clear trading interface.

Older Platform With Slim List Of Trading Instruments

With Deribit you can trade Bitcoin Futures, Options and one perpetual SWAP instrument which is BTC/USD. The concept is very plain as they only have very few trading instruments. Here is the overview:

- BTC/USD (perpetual contracts)

- BTC/USD Futures

- ETH/USD Futures

- BTC/USD Options

Insurance Funds For Bankrupt Accounts

One particular feature of Deribit is their insurance fund that is made to cover the losses of bankrupt traders. With every liquidations that occurs an extra fee of 0.45% gets paid into the fund. Even if the fund is depleted the bankrupt traders get funds from the winning traders.

Advanced Futures Trading Engine

Deribit has an advanced trading system with all kinds of oders settings even including “hidden”. The only order type we can’t find is trailing stop.

The user interface is as simple and plain as the portfolio. Deribit is older than most other bitcoin margin trading sites as it was already established in summer 2016. As they are still providing service the platform seems to be reliable and stable. Also they are one of the very few platforms offering classic Bitcoin Futures trading with precise settlement dates (like BitMEX does).

Overbit is another relatively young bitcoin trading platform with high leverage and perpetual contracts. What sets them appart from the others is the fact that they follow a strict KYC policy which means that traders have to verify their identity with ID document right at sign up, otherwise they can’t start trading.

With this broker you can trade 9 different cryptocurrencies. The altcoins are traded against Bitcoin. BTC is traded against USD or JPY.

Perpetual Contracts:

BTC/USD, BTC/JPY, ETH/BTC, XRP/BTC, LTC/BTC, EOS/BTC, BCH/BTC, ADA/BTC, NEO/BTC

No Trading Fees

Among all brokers listed on this page Overbit is one of two brokers that don’t charge any trading fees (the other one is SimpleFX). They are financed only by SWAP. They don’t have many advanced orders, but stop loss and take profit are of course part of their system.

Buy Bitcoin With Credit Card

Monfex is a crypto margin trading platform that differs from the other mentioned platforms in so far as there you don’t have to own Bitcoin yet in order to start trading. Here you can buy Bitcoin with credit card. In this case you need to make a full ID verification, which is always the case when fiat money comes into play.

If you already have cryptocurrencies (BTC, ETH or Tether), you can start trading right away, without KYC.

Margin Trading Academy For Day Trading Beginners

Another unique approach is that they try to help people become better traders by offering a trading academy to learn day trading. So Monfex is targeting newbies in particular, although the platform is also suitable for professional traders. But the trading engine is rather basic, so there are not many advanced order types.

Location-wise they seem to target Latin-American traders as their website can also be viewed in Spanish and Portuguese. German, Russian, Polish and Chinese speaking traders are also among their target groups. As always, US traders can’t use the broker.

Wider Trading Portfolio + Stocks, Indices & Forex CFDs

Monfex has a longer list of trading instruments than most other bitcoin margin brokers. Besides Bitcoin a range of altcoins can be traded against the US Dollar, but they also have some Forex pairs, Stock indices and precious metals. This portfolio makes the platform appealing to traders who not only trade cryptocurrencies.

While Cryptocurrencies can be traded with 1:20 leverage by default (higher leverage on request), leverage for Forex pairs is up to 1:100, which is normal. Forex leverage is usually quite high. The Stock Indices again can be leveraged up to 1:20. Precious metals can ba traded with up to 1:50 leverage.

Cryptocurrencies at Monfex:

BTC/USD, ETH/USD, XRP/USD, LTC/USD, DSH/USD, EOS/USD, NEO/USD, BCH/USD, ZEC/USD, XMR/USD, OMG/USD

Forex Pairs at Monfex:

EUR/USD, NZD/USD, GBP/USD, AUD/USD

Precious Metals:

XAG/USD, XAU/USD

Stocks CFDs:

BRN/USD (Brent Crude), ES/USD (S&P500), YM/USD (Dow Jones)

Crypto Leverage Ratios in Detail at all Brokers:

| BTC | ETH | LTC | XRP | EOS | BCH | XMR | other | |

|---|---|---|---|---|---|---|---|---|

| Binance | 1:125 | 1:100 | 1:75 | 1:75 | 1:75 | 1:20 | 1:75 | 1:75 |

| BitMEX | 1:100 | 1:50 | 1:33.3 | 1:20 | 1:20 | 1:20 | – | 1:20 |

| Bybit | 1:100 | 1:50 | – | 1:50 | 1:50 | – | – | – |

| PrimeXBT | 1:100 | 1:100 | 1:100 | 1:100 | 1:100 | – | – | – |

| BaseFEX | 1:100 | 1:20 | 1:20 | 1:20 | – | 1:20 | – | 1:20 |

| Deribit | 1:100 | – | – | – | – | – | – | – |

| MoneFEX | 1:50 | 1:20 | 1:20 | 1:20 | 1:20 | 1:20 | 1:20 | 1:20 |

| Overbit | 1:50 | 1:20 | 1:20 | 1:20 | 1:20 | 1:20 | 1:20 | |

| SimpelFX | 1:6 | 1:3 | 1:3 | 1:3 | – | 1:3 | – | 1:3 |

| eToro | 1:2 | 1:2 | 1:2 | 1:2 | 1:2 | 1:2 | 1:2 | 1:2 |