Save Money With These Brokers:

Margin Trading Fees explained on the basis of BitMEX – other platforms work pretty much the same. So this is a standard fee model for Bitcoin margin trading brokers with perpetual swap contracts. Only the height of the fees may vary a bit, or the funding rates and intervals. We’ll explain this in detail further below.

Typical Bitcoin Margin Trading Fee Model

Maker

Maker Fees are 0.025% of your position size.

The maker (or market maker) is the one that puts his order in the order book first. As soon as somebody else puts a matching order into the order book, a trade will be executed. So the person who “takes” the order of the market maker is the taker.

When putting a limit order you can become either maker or taker. It depends if there was already a matching order in the order book or not. If your order gets executed with somebody else’s order and yours should have been earlier in the order book than his order, than you are the maker. And the other way round..

In the case of a market order, you will never be maker, because market orders don’t wait in the order book for matches. They get executed immediately as a match with limit orders that are already there. Market orders are always taker orders:

Taker

Taker Fees are 0.075% of your position size.

So the taker is always the one that “takes” the limit order of somebody else out of the order book – or, who performs a market order. If you want to avoid becoming the taker when setting a limit order, you can check the “post only” check mark. This will make sure that your limit order will wait in the order book until somebody else sets a matching order later than you – so he becomes the taker. So logically, two traders with “post only” check mark won’t get into a trade together, since both insist in being the maker of their particular trade.

“Post only” check mark

=> possibility to make sure that you only pay the maker fees in a limit order (which is 3 times lower than taker fees in the case of BitMEX).

However, such specific settings could mean that your order doesn’t easily get executed, depending on current market liquidity. If there shouldn’t be matching orders, your order will stay untouched. So this is something to consider.

From What Exactly Do The Fees Get Deducted:

Fees Relate To Position Size Only

Leverage itself doesn’t have anything to do with it.

The fees are based on the position size. It doesn’t matter with how much leverage / own margin you open this position:

Example:

If your position size is $1000 with 10x leverage, your margin is $100. If your position size is again $1000, but your leverage is 100x, you only need $10 margin. If you don’t use leverage at all, your margin is $1000 in this case, so it equals the position size. No matter how much margin / leverage you use, the fees will always get deducted from the $1000.

If you’ve set a limit order with “post only”, you will pay 0.025%, which would be $25 in the case of a $1000 position. No matter how much leverage is behind this trade.

So be aware that fees get 3 times as high if you pay the taker fees, which would be $75 in the case of a $1000 position. This is always the case if you perform a market order (=> market order always means being the taker).

If you hold this position over the funding hour, you might have to pay the funding rate on top of that:

Funding Rate – BitMEX Funding Explained

Funding rate is known from the traditional Forex and Stocks markets where it was invented to keep price of CFDs in line with the actual price of the underlying asset. This fee is only being exchanges between the traders themselves, it’s not a fee for the broker platform. The funding rate was designed to motivate traders not to keep their positions open forever. This measure aims to stimulate a balance between changing positions.

In the case of BitMEX, the funding rate changes every 8 hours, when it gets recalculated for the next 8 hour period. Only leveraged positions that are being held over that timestamp get charged. That’s why many traders close their positions within half an hour right before the end of the current funding interval. If you don’t use any leverage at all, like opening a $1000 position with your entire $1000 stake, then you’re not getting charged the funding rate, since this fee is only related to borrowed money (when using leverage you borrow money from the exchange).

The funding rate is permanently calculated dynamically, from the leverage interest rate and the discount/premium factors. So it might change for the next 8 hours interval.

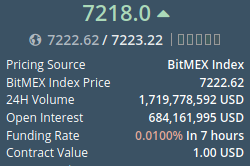

At the time of writing, it’s 0.0100% on BitMEX, longs have to pay shorts as the number is positive.

You always see the current funding rate in the position widget together with the time that is left. When the funding rate is positive (without a minus), then long positions have to pay shorts. So it depends on your position whether it is long or short, if you have to pay this fee or if you get it as a rebate.

You always see the current funding rate in the position widget together with the time that is left. When the funding rate is positive (without a minus), then long positions have to pay shorts. So it depends on your position whether it is long or short, if you have to pay this fee or if you get it as a rebate.

Due to the fact that the funding rate is only charged for positions that are being held over those timestamps 3 times a day, many traders close their position in the 30 minutes before the fee would get charged.

This is why the hours when the funding rate occurs can be a good time to go for a intra-day long for short term profits (scalping).

- Positive funding rate: longs pay shorts

- Negative funding rate: shorts pay longs

Isolated Versus Cross Margin

Isolated margin means that you define the exact amount of margin involved in a position. If this margin shouldn’t be sufficient anymore, you can get liquidated unless you manually add more stake (margin).

Cross margin on the other hand automatically uses all of your account balance in case the initial margin of a position of yours shouldn’t be sufficient. Cross margin can dynamically move margin between your open positions to protect them from liquidation. The big danger of cross margin is that this way you can potentially lose all of your account balance, in case you don’t use a stop loss and price moves too far in the wrong direction. Cross margin is only recommended for experienced traders.

Does Cross Margin Lead To Higher Fees?

No, it doesn’t matter if you use isolated or cross margin in your BitMEX account, fees will always be the same.